Behind the Label: Unveiling China's Influence on Pharmaceuticals like Trikafta and Imbruvica

Notorious for its cheap production costs, many consumer products in the United States display “MADE IN CHINA” on the label. There are long-held concerns when it comes to this dynamic: about our national security, the economic well-being of the American middle class, how poor labor conditions amount to those online deals, etc. These concerns extend to the pharmaceutical industry, wherein the majority of the U.S. generic drug supply consists of active ingredients (APIs) sourced from India and China. According to Public Citizen, in 2019, China emerged as the top U.S. source of pharmaceutical imports by volume – followed closely by India and Mexico, prompting questions about our reliance on foreign drug production.

Top 10 U.S. Sources of Pharmaceutical Imports by Volume vs. Value of Those Imports (Public Citizen, 2019)

Image as seen on Public Citizen. Data sourced from the U.S. International Trade Commission.

Where does U.S. outsourcing of prescription drug manufacturing leave us, when, say, there’s a global pandemic afoot or tensions flare between two nations battling to be the ultimate economic superpower? A 2021 report entitled “National Strategy for a Resilient Public Health Supply Chain,” issued by the Administration for Strategic Preparedness and Response highlighted a “need to mitigate the effects of global supply chains.” Fast forward to 2024 where active drug shortages in the United States have hit an all-time high. Although causes of such shortages are varied, organizations including the American Medical Association and US Pharmacopeia have proposed incentivizing the on-shoring of our API and finished drug product development to improve the resilience of the United States healthcare supply chain.

However, given just how much the U.S. relies on importing its medicine cabinet, solely pointing to domestic manufacturing as the remedy to our supply challenges isn’t practical. Our drug supply is unavoidably global. According to a recent New York Times report by Christina Jewett, over half of biotech companies say it would be “extremely difficult” to circumvent manufacturing drugs in China. Moreover, production issues in facilities based right here in the United States contribute significantly to drug shortages. Jewett’s reporting highlights the Chinese firm WuXi AppTec and sister company WuXi Biologics and their entrenchment in the U.S. drug supply, manufacturing active ingredients in various treatments, including cancer, cystic fibrosis, HIV, and obesity.

The Times report includes an estimate that Wuxi alone “has been involved in developing one-fourth of the drugs used in the United States.” However, just as Americans have learned that a U.S.-based company does not equal domestic production, a Chinese drug company doesn’t equal China-located factories: WuXi is bringing its production footprint to the United States, with sites – some already established and others in the works – in Massachusetts, Delaware, and Philadelphia.

While China may lead as the largest supplier of bulk pharmaceutical ingredients, historically many of those have been for over-the-counter products or generic drugs – but seldom for the APIs that go into patented, brand-name drugs as shown in PharmacyChecker’s research “Not Made in the USA: The Global Pharmaceutical Supply Chain and Prospects for Safe Drug Importation.” In fact, Imbruvica (ibrutinib), the only brand name drug we found in that 2022 report to have manufacturing origins in China was also mentioned in Jewett’s reporting. Imbruvica’s active ingredient is manufactured in WuXi subsidiary factories in Shanghai and Changzhou.

WuXi's Involvement In The U.S. Drug Supply Chain

| Brand Name | Active Ingredient | Marketing Authorization Holder | Active Ingredient - Manufacturer Location | Finished Drug Product - Manufacturer Location |

| Imbruvica | ibrutinib | Janssen Biotech and AbbVie | China (WuXi subsidiary factories in Shanghai and Changzhou) | USA |

| Jemperli | dostarlimab | GlaxoSmithKline LLC | USA | USA (Philadelphia - WuXi Biologics) |

| Trikafta | elexacaftor/tezacaftor/ivacaftor | Vertex Pharmaceuticals | Portugal; Ireland; Spain; Italy; China (WuXi affiliate located in Shanghai) | USA |

| Zepbound | tirzepatide | Eli Lilly | USA | USA (WuXi rumored to be a part of production process) |

PharmacyChecker Research 2024 | Data Source: National Library of Medicine and the New York Times

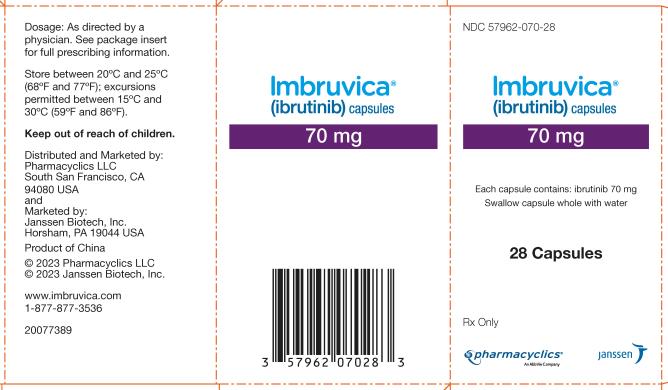

Followers of PharmacyChecker’s work know that the pharmaceutical drug supply chain is as opaque as it is global. Brand Imbruvica’s U.S. label (shown below) reads “Product of China.” When conducting research for “Not Made in the USA”, PharmacyChecker called Abbvie and spoke to a representative who said that “the manufacturing, testing, packaging [of Imbruvica] is done across multiple locations in the USA.”

Confused as to why we reached out to Abbvie concerning Imbruvica’s manufacturing origins considering the only drug companies listed on the label are Janssen Biotech and Pharmacyclics? Imbruvica was co-developed by Johnson & Johnson and Pharmacyclics in 2011; Pharmacyclics was acquired by Abbvie in 2015; and Janssen is owned by Johnson & Johnson. Seeing as we’re discussing pharmaceutical manufacturing in China, an interesting tidbit: Janssen was actually the first Western pharmaceutical company to set up shop (a factory) in the People's Republic of China – operating under the name Xian-Janssen Pharmaceuticals in 1985.

Abbvie’s representative’s response indicates that while the active ingredient is manufactured in China (and we now know thanks to the New York Times, specifically by WuXi in Shanghai and Changzhou), the drug product is likely finished in the United States. Due to various labeling laws and differing definitions between authorities, the U.S. Food and Drug Administration (FDA) would not consider Imbruvica an imported drug; Customs and Border Protection (CBP), however, would.

Image Source: National Library of Medicine

PharmacyChecker price comparisons reveal significant cost disparities between the U.S. and other countries for drugs like Imbruvica. Online pharmacies that offer international mail order show prices of Janssen-made Imbruvica sold in Canada for around $4,000 per month less than it costs in the United States. Imbruvica can be ordered from Turkey for about half the U.S. price. A generic version is available and sold at PharmacyChecker-accredited online pharmacies that work with Indian dispensing partners. The Indian generic manufacturers include Natco and Sun Pharmaceuticals.

Imbruvica (ibrutinib) International Cost Comparison

420mg; 28 tablets

| US Price | US Coupon Price | Canada - International Mail Order Available | Turkey - International Mail Order Available | India Generic - International Mail Order Available | Savings |

| $17,269.89 | $15,770.16 | $13,164.48 | $8,416.80 | $513.24 | 97.03% |

Source: All pricing is derived from prices and quantities compared on PharmacyChecker.com in April 2024. International online pharmacy prices include shipping costs.

The Times report mentions a few other brand names associated with WuXi. Jemperli (dostarlimab), an endometrial cancer drug distributed by GSK, is manufactured by WuXi Biologics likely in Philadelphia. Wuxi is also rumored to take part in the production of Lilly’s popular obesity drug, Zepbound (tirzepatide). PharmacyChecker found that neither the drug label nor FDA data on those drugs explicitly pointed to foreign-based production.

The active ingredients in Trikafta (elexacaftor/tezacaftor/ivacaftor), an expensive drug marketed by Vertex Pharmaceuticals for the treatment of cystic fibrosis, have manufacturing in Portugal, Ireland, Italy, Spain, and China. The below U.S. drug label explicitly says that "Elexacaftor/Tezacaftor/Ivacaftor made in US of imported ingredients; Ivacaftor made in Ireland."

Image Source: National Library of Medicine

Trikafta's Inaccessibility

For patients in the U.S., Trikafta's retail price is a staggering $320,000 per year. Meanwhile, the cost of production for elexacaftor/tezacaftor/ivacaftor is estimated at around $5,700 per year. Its Chinese manufacturer, Shanghai SynTheAll Pharmaceutical Co., Ltd., is an affiliate of WuXi.

Unfortunately, American patients don’t have the protections afforded to consumers in other high-income nations: Australia’s Pharmaceutical Benefits Scheme helped lower Trikafta’s cost from $21,000 to $6 per month. Marketed under the name “Kaftrio” in Ireland, the country’s Health Service Executive approved full funding of the drug for children aged six and over. In 2021, Vertex announced a reimbursement agreement reached with the Spanish Ministry of Health for people ages 12 years and older.

For patients in other parts of the world, cost isn't the only barrier. Vertex Pharmaceuticals, based in the United States, markets its cystic fibrosis miracle drug all over the world – but, depressingly, not in developing countries. Legal battles have ensued to make the drug accessible in regions like South Africa, and compulsory licensing may well force Vertex to reconsider its pricing strategies in countries like India, Ukraine, and Brazil.